Divorce can be an overwhelming experience, impacting every corner of a person’s financial life, from untangling assets and debts to making critical decisions about real estate, credit, lending, retirement, investments, and future planning.

Navigating this complex process alone can feel daunting, but with the right support, it’s possible to approach it with clarity and confidence. A comprehensive approach to divorce involves addressing the emotional, legal, and financial challenges through a tailored strategy that ensures no aspect is overlooked.

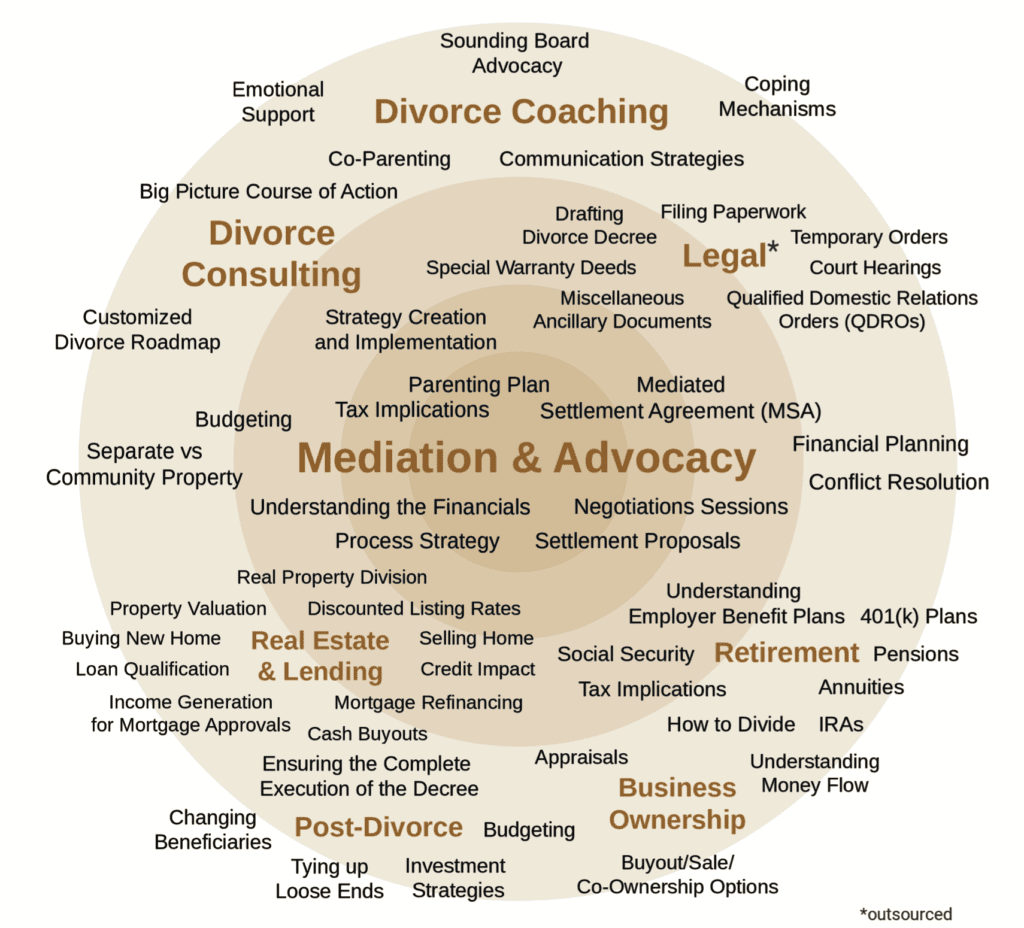

One key element of this process is creating a customized roadmap that provides a clear overview and a structured course of action. Emotional support plays a vital role, offering a sounding board, coaching, coping mechanisms, and co-parenting strategies to help manage the stress and uncertainty that often accompany divorce. On the mediation and advocacy front, effective communication strategies, drafting a divorce decree, filing paperwork, and navigating temporary orders, court hearings, and qualified domestic relations orders are essential. For those who prefer mediation, mediated settlement agreements, financial planning, conflict resolution, and settlement proposals can provide a less adversarial path forward, with some legal services potentially outsourced to ensure expert handling.

The financial and real estate aspects of divorce are equally critical. Property valuation, buying a new home, loan qualification, and income generation for mortgage applications are important considerations, as are discounted listing rates, selling a home, credit impact, mortgage refinancing, and cash buyouts. Ensuring the complete execution of the divorce decree, tying up loose ends, and planning for the future are also key steps. This includes changing beneficiaries, budgeting, developing investment strategies, and exploring buyout, sale, or co-ownership options for businesses. Understanding benefit plans, social security, tax implications, 401(k) plans, pensions, annuities, IRAs, and overall money flow further ensures financial stability post-divorce.

A well-rounded approach also involves strategy creation and implementation, such as developing a parenting plan and addressing tax implications to cover all bases. Every divorce is unique, and a customized solution allows individuals to focus on the services that best meet their needs. With the right guidance, the challenges of divorce become manageable, enabling a smoother transition to a new chapter. By addressing the emotional, legal, and financial dimensions with clarity and confidence, individuals can move forward with a solid foundation for the future.

This is where Your-Divorce.com steps in to make a difference, offering 24-hour dedication to each client with an exclusive and fully involved approach that caters to all their needs, while remaining emotionally available to provide the support and understanding necessary during such a challenging time. Contact us so we can consider taking your case on.